The global fashion industry is facing economic uncertainty, a dynamic market and a change in consumer behavior. Finding growth pockets means navigating a complex maze.

Although it is difficult to predict, even in the best times, the fashion industry is especially turning through the tumultuous and uncertainty. Consumers suffering from recent inflation are becoming increasingly sensitive in prices. There is also a surprising increase in fraud, accelerating climate change, and constant change in global trade. Regional differences, which were focused in 2024, will become even more intense in the coming year.

In short, the negative environment that was predicted by many people in the fashion industry a year ago has now become practical. There is still a search for development, but changing the economic uncertainty, geographical differences as well as consumer behavior and priorities means that it will need to navigate the maze of complex challenges at every turn to achieve it. As a result, 2025 is likely to be calculated for many brands.

Slow Growth Continues

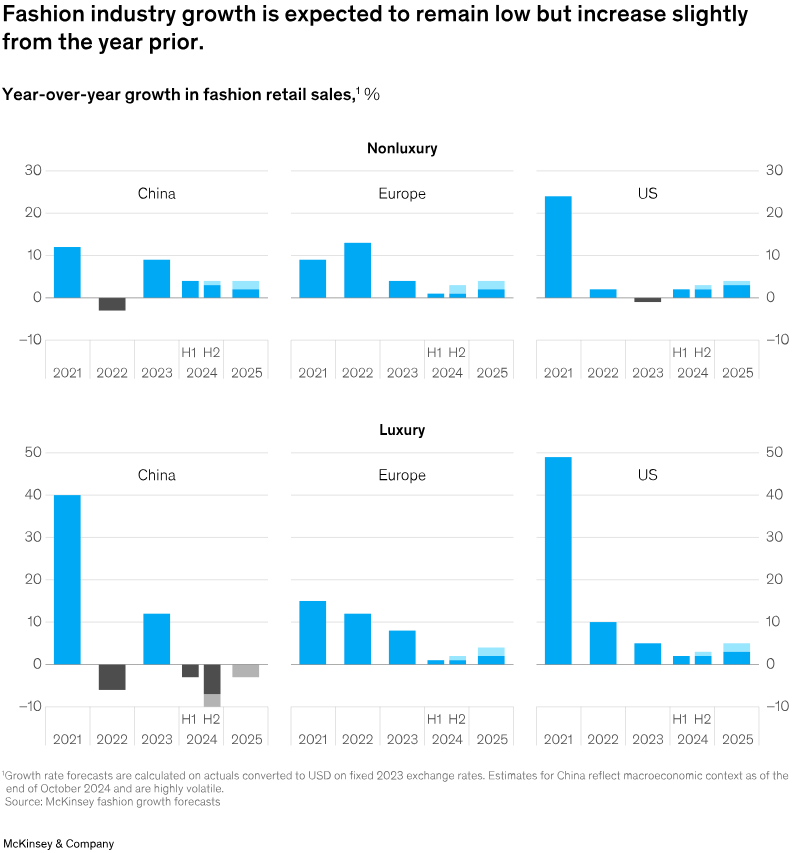

According to the top line purely, the fashion industry’s outlook for 2025 shows a continuation of the slowdown in 2024: Income is expected to increase in low single digits. While luxury has led to creating value in recent years, the McKinsey Global Fashion Index has predicted that in 2024, it is a luxurious thing that will advance the entire increase in economic profits for the first time since 2010 (except Covid-19 pandemic disease).

Our annual Bof -McKinsey State of Fashion Executive Survey was as disappointing as last year. Only 20 % expect consumers’ emotions in 2025, while 39 % are seeing industry conditions deteriorating.

The geographical motivations of income and economic profit are also undergoing historical changes. In particular, the industry will benefit from declining inflation and rising tourism in Europe, the flexibility of high -ranking people in the United States and new development engines in Asia (to counter the uncertainty around consumer costs in China, which is still recovering from pandemic disease). China will be the center of gravity in the region, but since the country is influenced by macroeconomic head windows, brands will focus on other Asian markets, especially Japan, Korea and India.

Acting on occasions

To reach these users, the executives told us that they would localize their Go -to -Market models, expand their prices, and focus on brand positioning to get the attention of buyers who are prioritizing value. This continuity is also increasing the re -sale and the extension of the lower parts. Brands that do not want to play in these categories should show us why their products are worth the premium price.

One way to get this is to improve the purchase experience. Consumers are returning to store in pre -epidemic levels in most parts of the world, but retailers need to remind buyers what they like about the experience inside the store. It starts with well -trained staff who are empowered to help and encourage customers.

In return to the physical retail, pure play luxury markets have struggled. In this coming year, a large number of online markets may be disrupted. Most have seen their share prices falling from the heights of pandemic diseases and have struggled to find a falling demand and the increasing cost of consumer acquisitions.

Smart e -commerce players are focusing on new routes to discover products. Buyers who were ever surprised at many online retailers are surprised by the seemingly endless selection. AI -powered curations, materials and search can help users discover brands and products more effectively – and feel more inclined to purchase.

Brands are also re -examining which consumers have to chase theovers. While the fashion industry has historically preferred young buyers, more than 50 consumers are growing as “silver generation” as a proportion to the overall population and fashion costs. In 2025, the brand will benefit from presenting these frequently ignored users.

Not all brands are equally expert in making these axes. Often, these are new, “Challengers” brands, which do not burden historical ideas about products, stores and consumers that are coming to the forefront. This is especially correct in the sports dress category, where officials are fighting the wave of small, but more innovative players who are rapidly gaining market share.

Next year, the changes in global trade should also be monitored and the impact on their sources should be expected. The retailers will accelerate their reorganization of the supply chain to prefer nearby coast and manufacturing in geographically affiliated countries.